What Climbing Interest Rates Mean for Annuities? Careful scrutiny of your retirement plans requires you to factor in annuities to balance your investment portfolio. Annuities remain reliable investment vehicles to generate a guaranteed income post-retirement. Meticulously planned...

This story originally appeared on Due

Careful scrutiny of your retirement plans requires you to factor in annuities to balance your investment portfolio. Annuities remain reliable investment vehicles to generate a guaranteed income post-retirement. Meticulously planned annuities often replicate monthly paychecks that reflect in the form of salary amidst rising interest rates.

Where Will I Start With My Annuities?

Well, you might be in a dilemma about when to start your annuities. Perfect timing ensures that you make the most of the market conditions. If you plan to predict the annuity rates in the future, it pays to start investing at the right time.

Adding to all the financial dilemmas — the FED keeps altering the interest rates. So, what does increasing interest rates mean for annuities? We have comprehensively covered the impact of climbing interest rates for annuities in this article. Having this knowledge will help you plan your investments and maximize your returns.

Different types of annuities in the US

Before jumping to the interest rate impact on annuities, first, let us learn the types of annuities you can invest in the US.

1. Immediate annuities

Immediate annuities guarantee payments to the investor within the first year. You can also get customized, guaranteed income. For instance, you pay $200,000 as a single premium to your insurer. As per the agreement, the insurer pays you $5,000 per month for a fixed period later on. The interest rates and market conditions determine the payout amount.

While deciding the type of annuities, it's imperative to consider your age. Otherwise, calculating your estimated requirements for retirement savings turns out to be challenging. Purchasing immediate annuities help guarantee a lifetime payout, regardless of your age.

However, the investor would be trading liquidity to warrant a fixed income. During emergencies, you won't have access to this fund.

The prime benefit of purchasing immediate annuities is that you get to know exactly how much you will receive after your retirement.

2. Deferred annuities

Through deferred annuities, you can receive guaranteed income in the future. This can be a monthly inflow of cash or lump sum income. You need to pay monthly premiums or a lump sum amount. Based on the type of investment you selected, the insurer will invest the amount consistently as per the contractual agreement. With deferred annuities, you can grow the principal significantly. These investments also bring you the opportunity to save taxes.

3. Fixed annuities

If you aren't willing to take on higher risk, go for fixed amenities. As per the agreement, your insurer will pay you a fixed rate of interest on your investment, which is guaranteed. You are going to receive the payouts through an agreed time period. Once the contract period expires, you can renew or annuitize your contract.

Besides, one can also get the invested dollars transferred into a different retirement account or annuity contract. As the interest rate is fixed, market volatility won't affect your returns.

4. Variable annuities

A variable annuity refers to a contract where the value is based on how the underlying sub-accounts perform. This is different from fixed annuities that offer a guaranteed return. However, you get to enjoy the scope of maximizing your returns by investing in a variable annuity. However, these investments tend to be riskier, as the value of the sub-accounts might fall, corresponding to adverse market performances.

Variable annuities hold the highest income potential. These annuity contracts are tax-deferred, enabling the investor to channel funds into sub-contracts. This is similar to your investments in a 401 (k). These sub-accounts help to maintain the growth trajectory of your annuity.

At times, these annuities can help you beat inflation. The sub-accounts, just like mutual funds, are subject to market performance and risk. Besides, you can get an income rider or a death benefit rider with variable annuities.

What makes timing crucial for investing in annuities?

Typically, the sale of annuities tends to shoot up with rising interest rates. This is because people would be interested in finding a safe place to park their funds while earning a decent return. For better returns during retirement days, starting your annuities is crucial when interest rates remain high.

On the other hand, the sales of annuities dip with low-interest rates. People feel the returns won't be too good during retirement. Naturally, they refrain from purchasing annuities when interest rates are low.

Now that the interest rates are soaring, people are keen to purchase annuities. Even if your workplace retirement plan or 401(k) is running dry, the income from the annuity will come in handy. Amidst a volatile market and increasing interest rates, this would be a great time to purchase your annuities.

Annuities warrant a consistent stream of monthly cash inflow

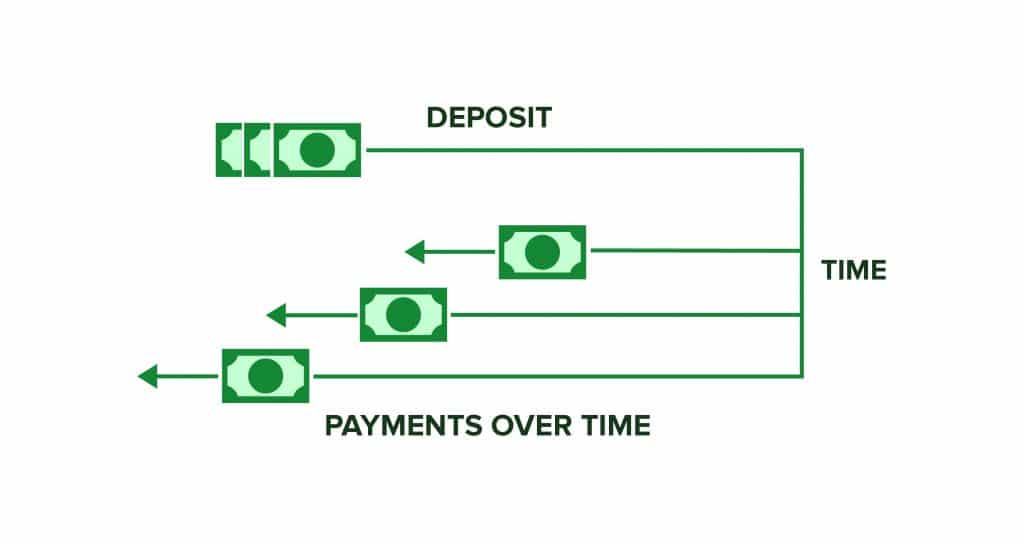

Annuities are designed to offer a consistent monthly stream of income. This is similar to your pensions and social security. While you will come across different types of annuities in the US financial market, the core concept remains the same. You pay premiums or invest your funds with an insurer. The insurer, on the other hand, keeps paying a regular amount of funds for the rest of your life as per the agreement.

Since 2022, the average payouts from annuities have shown more than a 13% increment for women and 11% for men. This statistic is based on the records of a 65-year-old woman and a 70-year-old man who invested a $100,000 lump sum in annuities. As per CANNEX, the average sum insurers offered at the end of April 2022 was $616, while it was $553 at the beginning of the year. In 2023, the interest rates have further increased, which can translate into higher annuity payouts.

Understanding the basics of returns through annuities

Whether you go for a variable or fixed annuity for monetary benefits, the issuer invests a sizable chunk of the assets in fixed-income debt securities, bonds, index points, or investment funds. Therefore, the performance of debt securities largely determines the returns you gain through annuities.

While dealing with bond issuers, the issuer of the annuity receives relatively higher rates. The crediting rate, or the rate at which the annuity issuer pays to the annuity holder, is slightly low. This difference is referred to as "spread.'

The trade groups and regulators in the US usually categorize the asset reporting for annuity products and life insurance together. According to the Fed, annuity and life issuers hold assets worth $9.8 trillion. This includes debt securities worth $4.4 trillion. In 2021, life insurers boosted their bond holdings in debt securities by $141 billion.

In 2023, if life insurers invest around $200 billion in bonds, it would result in an increment of 1.9% in the new money rate of the insurers. This can result in an increment of $3.8 billion in a single year in terms of interest that the life insurers and their clients receive.

Understanding the distribution of crediting rates and annuity spread

- According to S&P, indexed annuity issuers guarantee that holders would receive around a 3% to 4% average crediting rate.

- In December 2020, Moody's Investors Service stated nine life insurance companies in the US that had been encountering spread compression problems guaranteed rates between 4% and 5.5%.

- In 2021, American Equity stated that their aggregate cost of money was 1.55%.

- Lincoln Financial stated that the average interest rate at which it credited annuity contract holders was 1.93%.

In June 2021, the National Association of Insurance Commissioners declared that the overall average spread of life insurers between the net investment portfolio yield and their promised rate to clients dropped from 1.8% in 2007 to 0.63% in 2020. The aggregate investment spread of American Equity in 2021 was 2.18%, while it was 1.43% for Lincoln Financial.

How do higher interest rates translate into higher annuity payouts?

As an investor, it pays to know the factors on which annuity payouts are calculated. Insurers consider the client's life expectancy and interest rates as two of the prime determinants of payouts.

Amidst the pandemic, the Federal Reserve drastically reduced the interest rates to boost the US economy. However, during its recent meetings, the Central Bank has been compelled to increase the interest rates due to high inflation. The rates are further expected to rise in the current year.

Now, bonds continue to be the cornerstone of the annuity portfolios of insurance companies. With soaring interest rates, they can generate a higher return on new bonds. Naturally, they pass on the benefit to their clients, and you get to savor a higher monthly cash inflow.

Again, certain annuities, such as multi-year guaranteed annuities, serve like your savings account. At the end of the term, you may decide to convert it into a stream of regular monthly income.

The interest rate for a five-year multi-year guaranteed annuity at the end of 2021 was 1.95%. Around May 2022, it significantly rose to 2.9%. In 2023, the rates are further likely to increase.

Naturally, investors are keen to purchase annuities so that they can benefit from higher returns. Although the rates vary from one insurer to the next, they can still capitalize on the benefits. Before investing, it pays to scrutinize the financial strength rating of the insurers.

Usually, you would find financial firms like Moody's, Fitch Ratings, A.M. Best Company, or S&P Global Ratings attributing these ratings. A high rating implies that the insurer would be able to generate more income for you in the years to come.

Why is the US annuity market growing?

In the first quarter of 2022, fixed annuity sales in the US were recorded at $35.2 million. This marks a 14% Y-o-Y growth. At this time, the total annuity sales were up by 4%, at $63.6 million. By the end of 2022, the value was $310.6 billion, up by 22% compared to 2021.

This increment in annuity sales corresponds with the rise of interest rates. Evidently, the correlation explains that more people are purchasing annuities as the interest rates keep increasing. Their expectation of a better-guaranteed return in the coming years has been driving the US annuity market.

In 2023, the interest rates are expected to rise further, which would boost the customers' expectations. It remains to be seen what awaits the market in the remaining quarters of 2023.

Why should you buy fixed annuities with interest rates climbing?

As the interest rates keep rising, Americans are bracing to invest more in annuities. Let's evaluate the impact of increasing interest rates on borrowers and investors.

In case you are borrowing money, this wouldn't be a great time as you would end up paying more on interest. For instance, homeowners need to pay higher on their mortgages throughout their tenure.

Now, if you are enjoying a cash inflow through an instrument influenced by mortgaged rates, you would be on the gaining end. To take advantage of the market conditions, it would be a logical decision to invest in a fixed annuity. As the interest rates are increasing, you can lock the deal at a high rate throughout the term. Even if the Federal Reserve cuts the interest rate after a few months, the current rate would be applicable to you.

Insurance companies in the US issue these annuities. The interest that these insurers earn through their interests determines the pay to their clients. Therefore, a higher interest rate would translate into higher payment for you during the contract's dispersal period.

Let's take a case to help you understand the conditions better. In case a 70-year-old woman invested $1 million as a premium to purchase a life-only income annuity on 21st December 2021, the annuity payment would be around $67,204. However, the same product could have fetched her $71,926 had she invested the same amount on 22nd March 2022. The difference in payment is 7%, which can be even higher as the rates keep increasing in 2023.

Endnote

Annuities continue to be a core share of a well-balanced investment portfolio. If you are planning your retirement savings, it pays to consider the returns through annuities. Now that you know why timing matters while starting your annuities, this would be a great time to invest.

With the interest rates rising, annuity buyers can lock the rate and enjoy guaranteed returns after the tenure. Besides, the Federal Reserve is likely to further raise the interest rates in 2023. Even if you settle for a variable annuity, the climbing interest rates promise superior returns.

The post What Climbing Interest Rates Mean for Annuities? appeared first on Due.