What Industries Venture Capitalists Are Hot For Dow Jones VentureSource released its U.S. venture capital report today showing where VCs were investing, both by industry and geographically in 2013.

Opinions expressed by Entrepreneur contributors are their own.

If you are an aggressive entrepreneur gunning to grow a company quickly, then venture capital is probably your game. If you are going to try to pitch a VC, best go in with your eyes wide open, knowing what they want and where they are spending money.

In 2013, venture capitalists in the U.S. did more deals in information technology than any other industry by far, according to data on the market released today from Dow Jones's news and analytics platform, DJX. And while VCs did fewer deals in healthcare, U.S. VCs spent just as much in total on healthcare entrepreneurs than they did on IT entrepreneurs last year. That means that each deal that a VC signed with a healthcare entrepreneur had a larger price tag than did the average IT deal.

Related: Contently's New $9 Million Crown Proves Content Is King

After information technology, venture capitalists did more deals in business and financial services than any other industry. And after healthcare and IT, U.S. VCs spent more money on business and financial services than any other group of startups. Check out these charts showing in further detail where VCs invested their money in 2013, broken down by industry.

Click to Enlarge+

Source: DJX VentureSource

The end of 2013 saw a handful of large venture capital raises. Cloud-based storage company DropBox raised $250 million, social-media platform Pinterest raised $225 million and Nest Labs, which was recently acquired by Google, raised $150 million. All three are based in California's Silicon Valley.

Related: Head in the Clouds: Dropbox Reportedly Valued at $10 Billion

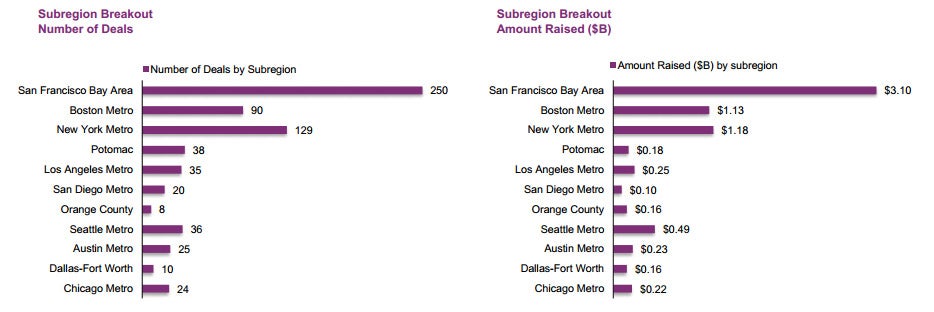

The locations of these big deals are indicative of where the heart of the market is located. Venture capital, as an industry, is still predominantly a West Coast game. In the last three months of the year, 250 San Francisco-based startups received VC funding, compared to 129 in New York and 90 in Boston. Here's a look at where the startups that got funding in the fourth quarter were located.

Click to Enlarge+

Source: DJX VentureSource

Related: $3M Jackpot: Google and Chase Give a Quarter Million Dollars to a Dozen Entrepreneurs