Twitter's IPO Will Make All These People Millionaires and Billionaires With the IPO set, Twitter's venture capital investors, longtime employees and other stockholders are about to become very wealthy.

By Jim Edwards

This story originally appeared on Business Insider

Investors have put $1.16 billion into Twitter since it was founded by Ev Williams and Biz Stone back in 2006.

The company has also shelled out $640 million in cash and stock for acquisitions.

With the IPO set to roll, Twitter's venture capital investors, longtime employees, and other stockholders are about to see all their paper equity turned into actual liquid stock and/or cash.

Some of them are going to be suddenly very, very rich.

Here's a look at who got what, per the S-1. For argument's sake, we're assuming an opening price of $29 per share, the most recent reported estimate. The S-1 says the most recent share valuation is $20.62, so the actual numbers could be lower than our estimates here.

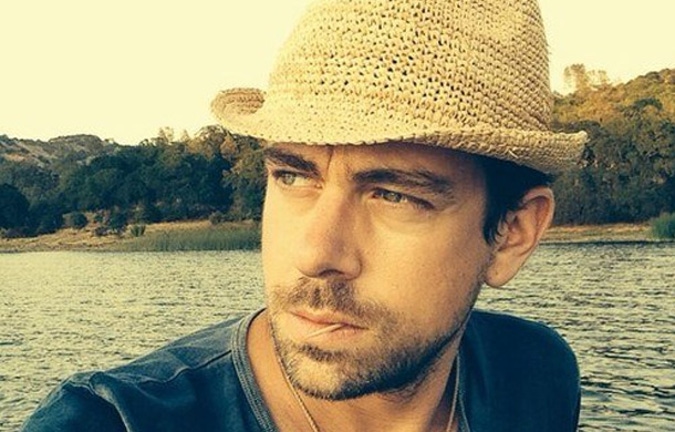

Jack Dorsey, executive chairman: $679 million

Total shares owned: 23,411,350

Estimated value: $679 million

Dorsey is one of the founders and owns 4.9% of the company.

Related: Twitter Is Smaller Than Facebook Because Twitter Is For The Elite While Facebook Is For The Masses

Dick Costolo, CEO: $220 million

Total shares owned: 7,589,608

Estimated value: $220 million

Ev Williams, founder: $1.65 billion

Total shares owned: 56,909,847

Estimated value: $1.65 billion

Williams owns 12%, the largest individual stakeholder.

Biz Stone, founder: $0

Total shares owned: None listed

Estimated value: $0

This is a bit of a mystery -- the founder of Twitter is not mentioned in the S-1. He may already have sold his entire stake to other investors prior to the IPO.

Adam Bain, president/global revenue: $50 million

Total shares owned: 1,722,350

Estimated value: $50 million

Series G holders: Yuri Milner 19s DST, T Rowe Price, Chris Sacca and others

Total shares owned: about 5%, or 24 million

Estimated value: $696 million

Related: What The Heck Is Wrong With Twitter? IPO Reveals The Company Has A Lot Of Work To Do

Union Square Ventures

Total shares owned: about 5%, or 24 million

Estimated value: $696 million

Noah Glass, "forgotten" founder: $0

Glass was not mentioned in the IPO. He is known to have reached a settlement with Twitter months ago that gave him some cash. It is not known how much.

Christopher Fry, svp engineering: $0 ... but lots of restricted stock

Twitter says, "Mr. Fry holds RSUs, none of which will be vested within 60 days of August 31, 2013."

Peter Currie, board member: $8.5 million

Total shares owned: 291,666

Estimated value: $8.5 million

Benchmark Capital: $915 million

Total shares owned: 31,568,740

Estimated value: $915, million

Benchmark owns 6.7% of the company.

David Rosenblatt, board member: $8.2 million

Total shares owned: 283,333

Estimated value: $8.2 million

Series C and D holders Rizvi Traverse and Spark Capital: $680 million

Total shares owned: 24 million (about 5%)

Estimated value: $680 million

Rizvi is reportedly backed by Chris Sacca, also. Sacca entities thus likely own combined stakes worth more than $1 billion.

Related: The Arrival Of Ads On Instagram Sets Up A Huge Mobile Video Fight With Twitter And Vine

Peter Chernin, board member: $3.7 million ... plus lots of restricted stock

Twitter says, "The Chernin Group, LLC, for which Mr. Chernin serves as founder and chairman, holds RSUs, none of which will be vested within 60 days of August 31, 2013."

Chernin received a $3.7 million payout as a board member.

MoPub stockholders: $429 million

Total shares owned: 14,791,464

Estimated value: $429 million

Twitter acquired mobile ad company MoPub for stock in a deal valued at $350 million. If the per share price of Twitter rises to $29, then MoPub equity holders could collectively realize a $429 million payout.

Image Credit: Twitter via @Jack

Image Credit: Twitter via @Jack Image Credit: AP

Image Credit: AP Image Credit: Jim Edwards / BI

Image Credit: Jim Edwards / BI Image Credit: Wikipedia

Image Credit: Wikipedia Image Credit: Business Insider

Image Credit: Business Insider Image Credit: YouTube

Image Credit: YouTube Image Credit: Twitter

Image Credit: Twitter Twitter

Twitter Image Credit: David Paul Morris/Bloomberg

Image Credit: David Paul Morris/Bloomberg Image Credit: editoratlarge.com

Image Credit: editoratlarge.com Image Credit: Chris Sacca

Image Credit: Chris Sacca Image Credit: Wikimedia, CC

Image Credit: Wikimedia, CC Image Credit: Jim Payne / LinkedIn

Image Credit: Jim Payne / LinkedIn