Last Minute Tax Strategies That Can Save You Thousands Don't miss this golden opportunity to save thousands before you file! Sign up for our webinar on March 13th as our experts, Mark J. Kohler and Mat Sorensen, help you keep more money in your pocket.

Originally aired Mar 13, 2024

Ready to save big with last minute tax strategies? Join our exclusive webinar, "Last Minute Tax Strategies That Can Save You Thousands" featuring renowned experts Mark J. Kohler, CPA, and Mat Sorensen. Here's what you'll learn:

Digging up missed deductions from last year for your business

HSA and IRA contributions before the deadline

Possible tax credits you might miss

How to approach your auto deductions for last year

How to approach bonus depreciation

What to do this year and not make the same mistake

Don't miss this golden opportunity to save thousands before you file! Secure your spot now and let our experts guide you toward financial success.

Bonus: All viewers unlock 25% off of Mark J. Kohler's book, The Tax And Legal Playbook, 2nd Edition! Just click here and use code TAXSAVINGS.

About the Speakers:

Entrepreneur Press author Mark J. Kohler, CPA, attorney, co-host of the Podcast “Main Street Business”, and a senior partner at both the law firm KKOS Lawyers and the accounting firm K&E CPAs. Kohler is also the author of “The Tax and Legal Playbook, 2nd Edition”, and “The Business Owner’s Guide to Financial Freedom".

Mat Sorensen is an attorney, CEO, author, and podcast host. He is the CEO of Directed IRA & Directed Trust Company, a leading company in the self-directed IRA and 401k industry and a partner in the business and tax law firm of KKOS Lawyers. He is the author of "The Self-Directed IRA Handbook".

Upcoming Webinar

Protecting Your Brand in the Age of AI: What Founders Need to Know Now

Join us for this free webinar to learn about protecting your brand, safeguarding your intellectual property, and navigating the gray areas of AI—before they turn into costly mistakes.

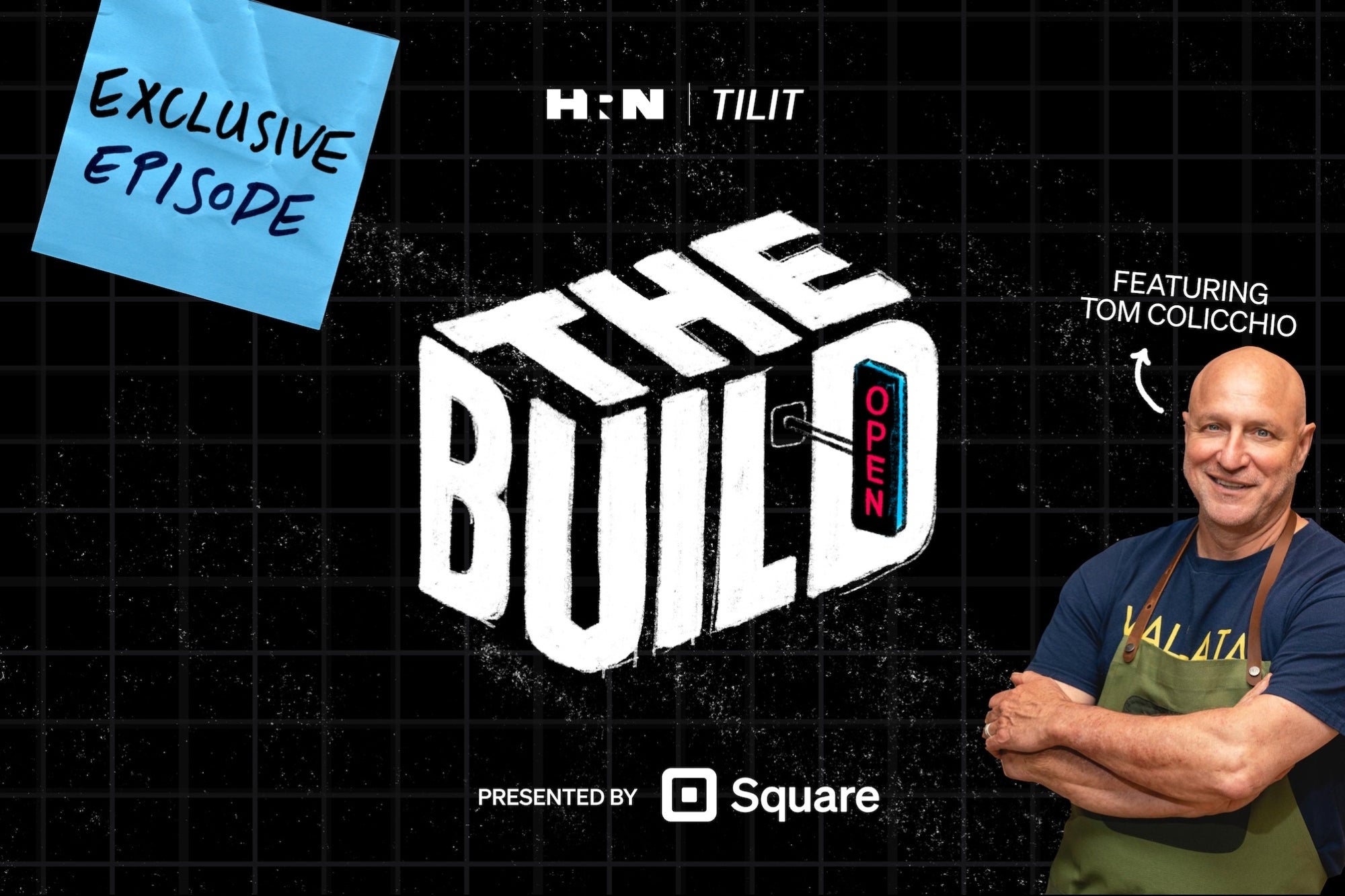

On Demand: How a Restaurant is Made

Opening a restaurant? Get insights and advice from chefs Rasheeda Purdie and Tom Colicchio on a bonus video episode of The Build, brought to you by TILIT and Square. Watch now.