A New Way To Trade: ilOsool Aims To Change The Way Illiquid Assets Are Traded In The MENA Region ilOsool wants to bridge the gap between deal seekers and market availability by offering a space where illiquid assets can be both priced and traded in a transparent, accessible manner.

You're reading Entrepreneur Middle East, an international franchise of Entrepreneur Media.

One of the mantras that wannabe entrepreneurs are often encouraged to chant before starting up a business is FANAFI: "Find a need, and fill it." And that seems to have been the principle Bdaiwi Tubaishat followed as he went about setting up his company, ilOsool, an illiquid assets trading platform for the MENA region.

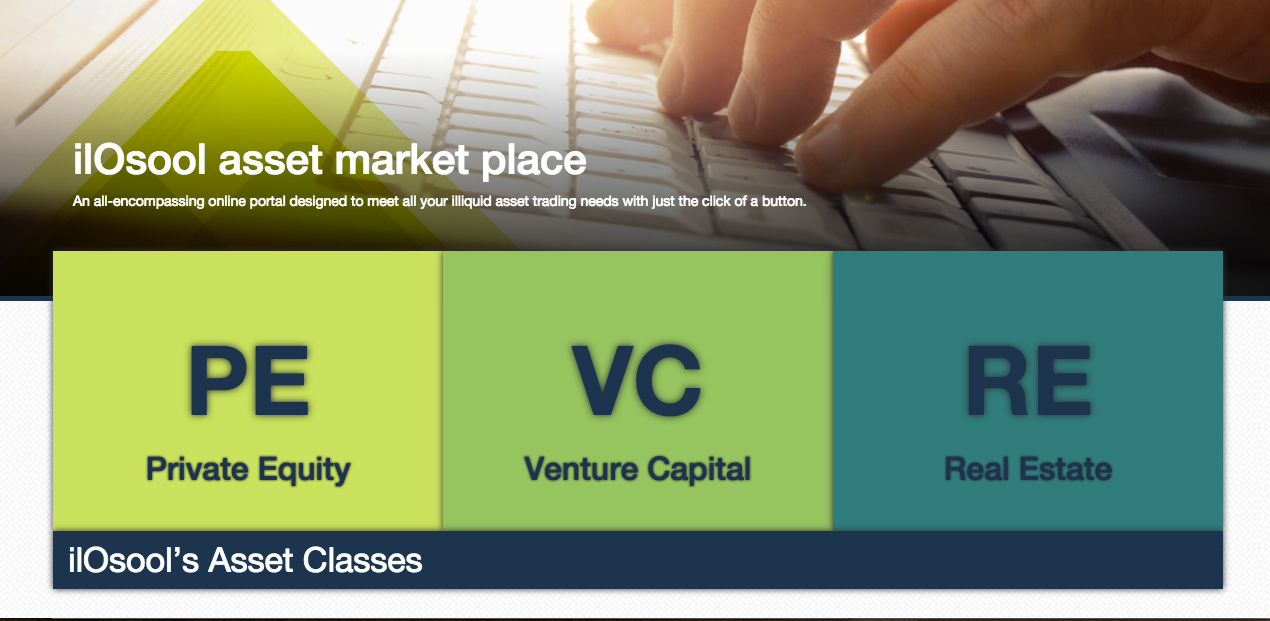

Having spent over 11 years in the finance and investment banking sectors in Dubai and Jordan, Tubaishat, who's the founder and CEO of ilOsool, saw a big need in the market for specialists in illiquid assets investments—for the uninitiated, illiquid assets refers to those assets that cannot be easily sold or exchanged for cash, such as real estate, private equity and venture capital. "These asset classes are not well served in this region," Tubaishat says. "People who have such assets find it very difficult to market their products, and people who want such assets find them very difficult to find as well."

Enter ilOsool. This online platform wants to bridge the gap between deal seekers and market availability by offering a space where illiquid assets can be both priced and traded in a transparent, accessible manner. According to Tubaishat, ilOsool has been created to facilitate a liquidity solution that is beneficial for both parties involved in an illiquid asset transaction, thereby avoiding the losses that are often associated with these kinds of deals.

While ilOsool had a beta launch in July, Tubaishat reveals that the platform is to have its official launch by the end of the year. When asked about the reception ilOsool has achieved so far, Tubaishat is frank in admitting that it has been hard to convince people to sign up for the same. "It's a new idea for people," he explains. "At first, you'll find a resistance from everybody, because there's no credibility, there's no track record… But we expected that. When we did our business plan and put together our SWOT analysis, we had said that this [reluctance] should be expected to happen initially."

"However, having said that, the performance of the site in the first three months was better than our estimates," Tubaishat declares. "We have around 40 deals listed on our website now, and we have more than 50 people as unique registered investors." While Tubaishat, who's also the managing director of Ultra Frontier, a Dubai-based financial consulting firm, used both his and his team's networks to publicize ilOsool's offerings, he noted that the company's social media presence has also helped a great deal in increasing its brand recall- for the record, ilOsool has 5000 plus likes on Facebook, and 1500 plus followers on Twitter.

Much like other startups in the region, ilOsool has a small team of six people- besides Tubaishat and two other analysts, there are three web developers who are based out of Jordan. While the company has a virtual office in Dubai, the team is mostly based out of Jordan as part of a strategy to cut costs, as ilOsool, for the moment at least, is being funded by Tubaishat alone. While he claims he isn't actively looking for investors for ilOsool, Tubaishat says he is open to interest on that front all the same.

While becoming an entrepreneur was something Tubaishat wanted to do ever since he was in high school, he notes that there were quite a few challenges he had to tackle before starting up ilOsool, most significant of which was giving up his steady job for this new enterprise. "That period when you decide [to become an entrepreneur], it's a very challenging time, and you need a lot of support," Tubaishat says. "Fortunately, my family supported me, and so did my friends, and I also had ideas coming in from investors with whom I had good relationships with."

Another worry that Tubaishat had when starting up ilOsool was the expenses involved in setting up the same. "Dubai is an expensive city," he explains. "If you want to have a startup in Dubai, even just starting it costs a couple of hundreds of thousands, you need a full budget. And without any investors, it makes you think twice about [the venture]."

But Tubaishat managed to get past this particular challenge by going to Jordan and building up a team there. "The IT-literate in Jordan is quite high, and you get good quality programmers there," Tubaishat says. "We cut costs a lot by going to Jordan and building a team there, while I stayed here [in Dubai], where the exposure and network is more prominent."

With most of the groundwork for ilOsool now in place, Tubaishat and his team are now hoping that the website now gets an active, interested audience. While the general feedback about ilOsool and its intentions have been good, Tubaishat notes that people may still be reluctant to join the site, given the novelty of it all. But ilOsool is trying to get past this challenge as well- Tubaishat points toward the free access being offered by the website, its easy sign-up process, and, of course, the social media exposure as well.

When asked about the growth prospects he hopes to see for ilOsool, Tubaishat is optimistic, but wants to remain realistic as well. "In the initial phase, my plan is to educate the target market and increase its awareness and acceptance of the concept we are offering," he says. "The timeline for the first phase is set to one year, during which ilOsool will be consistently supported by its sister company, Ultra Frontier, with regard to deal flow and client referrals."

"Afterwards, and during phase two, once the company has had enough exposure and its concept has been adopted, we hope to see a substantial growth in the users database of the platform," Tubaishat adds. "We see a great growth potential for the company, as the service provided is unique, and our technology and model are scalable."

Ask The Expert: What Are Illiquid Assets?

Assets including real estate, private equity and venture capital are not easily sold for two main reasons. First, there is often a lack of potential buyers, and second, clients rarely have access to an established market to help them move their assets and securities. One of the main challenges of illiquid assets is their inability to be converted into liquid assets at a profit; in fact, many are prone to losing a substantial portion of their estimated value, consequently making them higher risk assets. Factors such as political instability, economic crises and general lack of buyers make it more difficult to move illiquid assets when needed.