A Look at the New Gears the Auto-Motor Industries are Rolling Out What more is the auto-tech industry yearning for?

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

This decade can be conveniently called the decade of disruptions. While the auto tech industry has caught the eye of the millennials, its growth and demand have been bombastic as numerous enterprises, business and startups dived into the industry to leverage from the umpteen business opportunities it has to offer. Here are some businesses who are adding a new dimension to the auto-motor industry.

Royal Brothers

Royal Brothers is an example of one of the few bike rentals that are available in the Indian Bike rental industry. Recently, it bagged an investment of USD 1 million (Pre-series A). Entrepreneur India interacts with Abhishek Chandrasekhar, CEO and Director of Royal Brothers.

Disrupting the Auto Industry

Royal Brothers claim to be South India's first authorized bike rental company. Chandrashekhar says that he started it with a vision of being the most trusted company to rent affordable and quality bikes in every nook and corner of India. "We now operate in 18 cities and 6 states giving every traveller an opportunity to rent a quality bike across cities."

Market Size

The market size of Royal Brothers is about 10Bn for bike rentals in India. "Our geographical presence establishes that bike rentals in a need in metropolitan cities, tier 2 cities and tourist destinations." This, he adds, combined with this generation's preference to rent against buying makes the market size huge in India.

Decoding the Indian Auto Industry

Chandrashekhar believes that millennials are moving towards sharing economy. "Sharing economy gives a sense of ownership temporarily without the hassle of maintaining or selling an asset. We believe that bike sharing would be $10Bn market in India by 2025. We want to be a trusted brand present in every city across India and create an alternate means of transportation."

What are the problems you are looking to solve in the ecosystem? How Will the Funding Contribute to the Endeavour?

The major challenge for the ecosystem is still market awareness. Although bike rental is a very convenient option, people still do not think of it as an option when needed. Bike rental market has evolved in the last 3 years but the service is still available in a small percentage of the cities across India. By increasing our geographical presence and providing a seamless customer experience we are hoping that more people consider this as their preferred way to travel and explore.

We are planning to strengthen our presence in each of the cities that we are present in currently. We will also start operations in 25 more cities across 6 states and procure licenses to operate in 3 more states. We are hiring team members across all departments to help us with this rapid growth.

Kruzr

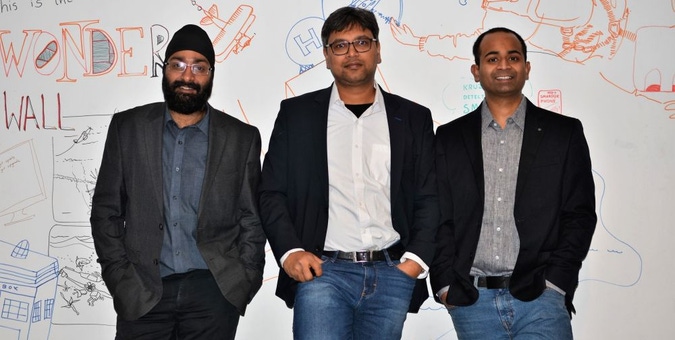

Kruzr is a preventive motor insurance technology which helps insurance companies personalize policy premiums and improve their risk model by delivering an engaging preventative driving assistant to their customers. Kruzr, founded by Pallav Singh, Ayan, and Jasmeet Singh Sethi, received funding of 1.3 million in a seed round of funding in the first week of February this year.

Here are some excerpts from an email interview with Pallav Singh, Co-Founder and CEO, Kruzr.

Built on the Core Values of…

Singh explains that Kruzr blends the power of voice technology and artificial intelligence in its personal driving assistant that helps drivers minimize mobile distractions, drowsy driving, speeding and external risks like weather and accident-prone zones. "In pilots with insurers, Kruzr managed to cut down distracted driving by 80 per cent."

Spreading Across Borders

Motor insurance is a $600 billion a year market, serving close to a billion drivers globally. Singh says, "We have global ambitions and are currently active in Europe, UK, and India. In our TG, we have the potential to reach close to 150 million drivers."At 20 per cent market penetration in these geographies, they can achieve revenues of $500 million adds Singh and further completes his plan of action of elaborating, "We plan to achieve this in the next 5 years."

From the Funding Plan

Recently, they received a seed funding of 1.3 million. We're using these funds to grow our technology team in India and the business development team in Europe. The funds will help us validate our product with insurers and customers in our TG and then begin the scaling-up process

Leveraging Technology

Singh highlights that the insurance industry is going through a major shift, aided by technologies like AI, data science, mobile tech etc. "Our ambition is to leverage these technologies to make insurance truly preventive and a partner in the life of customers." Their aim is to not be just a financial risk cover, but also to work with customers to help them live well and stay safe. "That apart, we also aspire to create a world-class technology product serving the global markets out of a team based in India."

Abhishek Chandrashekhar

Abhishek Chandrashekhar Jasmeet Singh Sethi, Pallav Singh, Ayan

Jasmeet Singh Sethi, Pallav Singh, Ayan