Enablers Of Success: Why Super Apps Aren't The Threat That Startups Imagine Them To Be Super apps can in fact fuel the emergence and growth of online startups.

By Dr. Fardad Zand Edited by Aby Sam Thomas

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur Middle East, an international franchise of Entrepreneur Media.

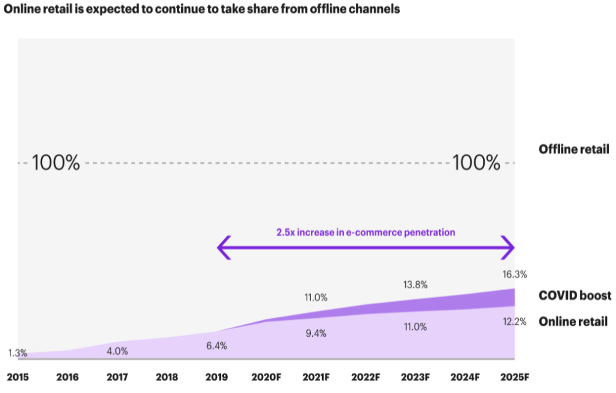

Since the COVID-19 pandemic hit the world in 2020, many things have changed in the way we live, work, and do business. One stark change concerns the importance of the online space to represent your business and offer your services and products. If being present and selling actively online was simply a choice or a nice-to-have thing for many businesses prior to the pandemic, it has become a critical must-have now. Online sales are taking a larger share of business sales across many industries (the so-called offline-to-online or O2O transition), and without a strong online presence, these businesses would have serious problems to compete and survive post-pandemic.

I believe that most of these consumer behavioural changes will remain with us even when the pandemic is a thing of the past, and hence, startups will evermore need to think about their presence and traction online. They have access to different channels to reach and serve their potential customers online: business websites/ portals, online aggregator platforms, social media, mobile and super apps, among others. Super apps are almost everywhere these days: WeChat, AliPay, and Meituan in China; Grab, GoTo, and Sea in Southeast Asia; Paytm in India; Careem, Snapp, and Noon in MENA; and Mercado Libre and Rappi in LatAm, among others. A super app offers several services and use cases of interest to its target customers in a single application.

Source: Dubai Chamber

Source: Dubai Chamber

This one-stop-shop philosophy implies that customers would only need to install one app, sign up once, add their credentials a single time, and then enjoy multiple applications at their fingertips right away, all-in-one. While super apps came to birth to bring convenience and value-for-money to their customers, they may be seen as potential threats to early-stage businesses and online startups. Over time, super apps continue consolidating demand, while expanding their service portfolio. On the other hand, they should be able to bring down unit costs, and pass on part of that to customers in the form of lower prices. More services and lower prices, complemented with enhanced experience and convenience for customers may be understood as leaving less room for online micro, small, and medium enterprises (MSMEs) and early-stage startups to scale and thrive.

Source: Kearney analysis

Source: Kearney analysis

However, that's not true; in contrast, I strongly believe that super apps can indeed fuel the emergence and growth of online startups, especially at times such as now that we are coming out of a large-scale pandemic gradually. Let's start with a stark example. WeChat launched its mini-programs in 2017. These are third-party applications that are developed and run on top of the WeChat platform and provide a wide variety of services and advanced features to its native customers. In just three years, the number of mini-programs on the platform grew 5.5x, while in the same period, the volume of transactions on these applications has doubled almost every year, to a point that these mini-programs already attract over 800 million monthly and 400 million daily active users in 2020. I strongly believe that such quantum-leap growth for these apps would have not been feasible without the underlying foundation of WeChat. Let's see why.

1/ Subsidizing Customer Acquisition Cost (CAC) Customer acquisition is probably the priority number one for any internet startup, being B2C or B2B; yet, CAC figures exhibit an upward trend across most industry verticals, meaning it is getting increasingly expensive to acquire new customers in most industries. There are several salient factors contributing to this upward trend, but (hyper) competition in most industries, on top of the multiplicity of channels (online, social, mobile, offline, hyperlocal) through which customers are getting approached and bombarded with ads and campaigns, are surely important contributors to this. With many businesses rushing online throughout the pandemic, the upward pressure on online customer acquisition costs will only intensify. Here, super apps can help new players with their prime magic. They have spent quite some time and millions of dollars to build a healthy and sticky customer pool, and once they open their platform to the broader ecosystem, all of the third-party tenants get access to their user base overnight, and benefit from the massive network effects they have created- way much faster and cheaper than what they could do/have done alone on their own. This is an indispensable asset for any startup that can boost its scale-up journey massively.

Source: 2019 Subscription Customer Acquisition Cost (Cac) Study

Source: 2019 Subscription Customer Acquisition Cost (Cac) Study

2/ Building Foundations If demand generation is critical for early-stage businesses, building a solid, scalable foundation and backend operations is probably not of less importance. Building tech and ops with decent quality and reliability, especially at scale, is neither cheap nor quick in many parts of the world, and particularly so in less mature environments. When expansion to multiple geographies is added to this equation, the situation becomes even more cumbersome for startups, as they need to build teams across different markets, deal/integrate with several local service providers, and comply with multiple regulatory regimes. Super apps have already gone through this tedious journey at scale, and can offer many of these building blocks such as payment, delivery, care, location, analytics, and identity in the form of platform-as-a-service (PaaS) microservices to startups. This would allow startups to focus their team-building, product development, and on-ground operations on their core business (something that they are supposed to be good at), and leave the most of remaining building blocks to their hosting super apps (while benefiting from the economies-of-scale they have captured). This can also accelerate time-to-market (TTM) for these startups, especially when launching in an absurdly new territory.

Source: OECD's elaboration based on data from the US CensusBureau, the Office for National Statistics in the United Kingdom and Eurostat

Source: OECD's elaboration based on data from the US CensusBureau, the Office for National Statistics in the United Kingdom and Eurostat

3/ Enhancing Visibility It takes a big marketing budget for startups to create sufficient visibility and awareness about their offerings, and to build trust with their target audience. It is even more challenging and costly for them to build a strong brand and reputation that lasts for decades. Partnering with established super apps is a great way for startups to get ahead of their competition and prove that they have already attained the stamp of approval from these giants. This can also improve customers' confidence in these new players and their comfort with sharing their data and credentials with them early on, as the smaller players working with or running on top of the super apps are believed to follow their strict security, privacy, integrity and compliance requirements. Super apps can also create healthy competition in the startup ecosystem in their dominant markets by separating the wheat from the chaff, and picking up the best-of-breed startups that they want to host or partner with. In return, they help these startups with demand generation, infrastructure scaling-up, and brand building in ways the startups cannot think of or are not capable of. This way, the emergence of super apps in most markets represents a great opportunity for startups to focus on their core competencies, and build long-lasting businesses for generations to come, while they can still choose to operate standalone and run their own channels in parallel as well. In short, super apps can be the ultimate multi-purpose tool, the Swiss army knife in business for emerging startups, all the while turning threats into opportunities for them to boost their offline-to-online transition, post-pandemic and beyond.

Related: Mindshift Capital Proves That Women-Led Tech Companies Are An Untapped Market With Great Upside