Fearful of the Russo-Ukrainian Conflict? History Says It's a Buying Opportunity InvestorPlace - Stock Market News, Stock Advice & Trading TipsGeopolitical tensions, like the current Russo-Ukrainian conflict, have historically caused a very average drawdown in the market. Don't fear; buy...

By Luke Lango

Our biggest sale — Get unlimited access to Entrepreneur.com at an unbeatable price. Use code SAVE50 at checkout.*

Claim Offer*Offer only available to new subscribers

This story originally appeared on InvestorPlace

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Russia has decided that it wants to invade Ukraine, adding a log to the current Russo-Ukrainian conflict fire — as if the stock market needed something else to shake things up. And while an invasion hasn't yet happened, intelligence reports indicate that it will likely happen this week.

Unsurprisingly, ever since news of the invasion broke last Friday, stocks have been spiraling lower. But history says that this could be a great time to buy the dip!

I know — sounds crazy. How can geopolitical conflict be good for the stock market?

Well, these conflicts don't drive stock prices. Valuation multiples and earnings do. And, historically speaking, geopolitical struggles don't have much impact on either!

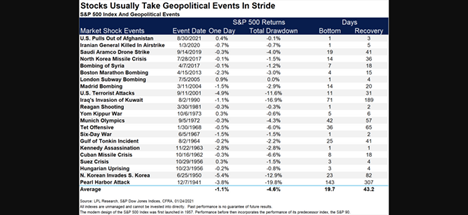

Since 1940, tensions like this — like an impending Russo-Ukrainian war — have resulted in an average drawdown of just 4.6% in the S&P 500 over a 20-day stretch. That's nothing. Since 1950, the market has averaged about three 5% pullbacks per year. So these geopolitical conflicts fall under the category of "run-of-the-mill pullbacks that are just good buying opportunities."

That's especially true if you look back on big geopolitical clashes, like Pearl Harbor and the Sept. 11 attacks. Both of those were direct assaults on U.S. soil. But a Russo-Ukrainian conflict is far from that. So excluding those events, you're talking about an average drawdown in the market — fueled by foreign geopolitical issues — of just 3.5%.

Where are we in the current selloff? Well, news of an impending invasion really hit the tape around 1pm EST on Friday afternoon. The S&P 500 was trading at 4,480 at the time. Since then, it's dropped 2.4%.

Basically, we're almost at what would be considered a historically "normal" pullback in markets from an offshore geopolitical conflict already.

Time to buy the dip? You bet.

Don't Fear Russo-Ukrainian Tension; Buy the Dip

We're about three-fourths of the way through the fourth quarter earnings season. And thus far, the numbers have been great. Nearly 80% of companies have reported earnings above estimates. Roughly the same percentage have reported revenues above estimates. And the composite earnings growth rate to date is over 30%.

Those are some solid numbers. And we still have another few weeks to go!

During that time, we believe stocks will rally. Geopolitical fears will fade. Earnings optimism will take center stage. Stocks will move higher.

Therefore, we see the current selloff as a solid opportunity — especially in tech stocks because they're crushing it on the earnings front this season.

To date, tech companies are reporting over 13% revenue growth this quarter, on average, alongside 22% earnings growth.

Those strong numbers are converging on some pretty depressed valuations across the sector, setting the stage for some big rallies in tech stocks.

See: ServiceNow (NYSE:NOW), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Advanced Micro Devices (NASDAQ:AMD), Snap (NYSE:SNAP), Pinterest (NYSE:PINS) and more.

We think there are several more mega-rallies to come in tech stocks over the next few weeks. And that's why we're pounding on the table about them right now!

In particular, there is one, tiny $3 tech stock that we believe needs to be on you radar right now. While 99% of people haven't heard of this company, it's working on technology that could change the entire world.

And if that tech does make big waves, this tiny stock will soar by thousands of percent.

Interested? Click here to find out more about this potentially life-altering stock.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

The post Fearful of the Russo-Ukrainian Conflict? History Says It's a Buying Opportunity appeared first on InvestorPlace.