Perks of Selling Your Home Could Outweigh Challenges of Buying While it's a notoriously tough time to buy a home, the incentives to sell the one you're in could be too good to pass up. Most (89%) of current homeowners…

This story originally appeared on NerdWallet

While it's a notoriously tough time to buy a home, the incentives to sell the one you're in could be too good to pass up.

Most (89%) of current homeowners who want to list their homes right now say something is preventing them from doing so, according to NerdWallet's recently released 2022 Home Buyer Report. The most commonly cited roadblocks: concerns about finding a new house and paying too much for a new house.

It's true that finding a home and especially finding one that fits all of your needs is a challenge right now. Competition over the few homes on the market is driving prices up. It's taking multiple offers and sometimes a hot tip on a house not yet listed to close a deal. However, current owners have an edge. By making the most of the market on the seller side, they'll enter the buyer side with more money to fuel their buying power.

Buyers want your home

Inventory is so low, there are likely multiple buyers looking for a home like yours right now.

In 2019, there were 1.3 million homes on the market in any given month, on average. By 2021, the number of active listings had fallen by 57%, to 540,000 on average, according to NerdWallet's analysis of Realtor.com data. There was already a home shortage before the pandemic, but COVID-19 took a bad situation and made it worse. Now, homes are selling within days, not weeks or months, and commanding multiple competitive offers. That demand shows few signs of letting up.

Nearly 26 million Americans say they plan to buy a home this year, according to the Home Buyer Report. That number is unrealistic — typically 5 million to 6 million homes are sold each year — but it does indicate the flood of buyers isn't likely to subside.

Selling now may mean a bigger profit

High demand in the face of low supply has made for record high prices. This means you're more likely to pay off your current mortgage and walk away with a profit than you would've been just a few years ago.

Homes are also being listed at higher prices, and selling at or above asking price. In fact, buyers typically paid 100% of the list price in 2021, and 29% paid more than list price. While the sales price represents your ultimate financial benefit, getting offers over what you expect brings added excitement to the transaction.

Typical sale prices grew from $270,000 on average in 2019, before the pandemic, to $344,000 in 2021, according to data from the National Association of Realtors. And in some places, they've grown even more.

About three-quarters (74%) of sellers did not have to reduce their asking price at all in 2021, compared with 60% in 2019 and 39% a decade ago in 2011, according to NerdWallet's analysis. The analysis covered 10 years of data from the NAR's annual Profile of Home Buyers and Sellers report.

Closing day may come more quickly, with fewer sacrifices

Buying or selling a home is never a stress-free transaction, but selling now is far easier than in recent years. Not only do you stand to have multiple competitive offers, but you're also more likely to cruise through closing with fewer frustrations.

Homes are moving quickly

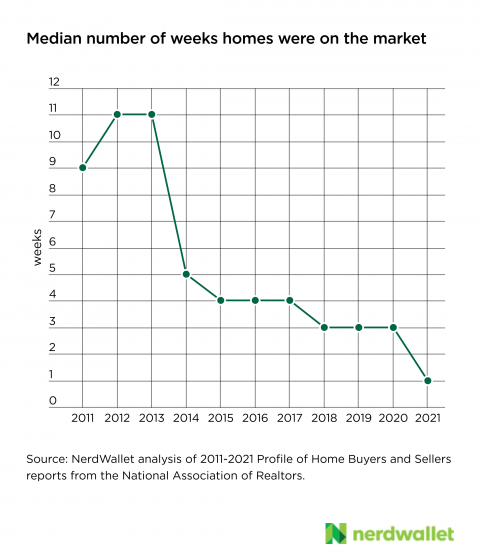

In 2021, homes were typically on the market for a single week, compared with 3 weeks in 2019, and 11 weeks in 2012 and 2013, according to our analysis of NAR data.

Sellers are having to give up less

It's relatively common for sellers to do some wheeling and dealing during the closing process — offering a warranty or money for repairs to the buyer, for instance. But those perks have become less common.

Almost three-fourths of sellers didn't offer any incentives to attract buyers in 2021, compared to about 60% 10 years ago, according to our analysis of NAR data. The share of those offering a home warranty fell from 23% to 13% during that same period, and the share of sellers assisting with closing costs fell from 20% to 9%.

You're more likely to walk away pleased

Closing on a home sale can leave you with lessons learned, if not regrets. But in this market, that's less likely. Seven in 10 (70%) sellers walked away from the home selling process "very satisfied" in 2021. A decade ago, just 54% could say the same, according to NAR data.

So, should you list?

If you've been thinking of selling, but are on the fence because you don't want to join the competitive pool of buyers, consider these questions:

Are you willing and able to move somewhere more affordable?

If yes, the profits from your sale will go further in a less competitive market. Not everyone wants to move to a rural setting (like I did), but your offers will be more attractive to sellers in areas where demand isn't as hot. You'll be able to make a larger down payment and possibly reduce your new mortgage's term, both of which stand to save you considerably over the long term.

Are you "over' homeownership?

If yes, it's perfectly fine to go back to renting, or move in with someone else who has a deed or a mortgage. Owning a home isn't for everyone, and it doesn't have to be forever. Further, owning a home can be expensive — 1 in 5 homeowners say affording home repairs and maintenance is among their top financial stressors for the next two years, according to the NerdWallet 2022 Home Buyer Report.

Are you highly motivated?

If yes, you're more likely to have what it takes to be a buyer in today's market. Finding a house you like will take time, and you might have to make offers on several homes before you go under contract. Being tenacious and knowing what challenges await you can better equip you for the potential battle ahead.

More From NerdWallet

The article Perks of Selling Your Home Could Outweigh Challenges of Buying originally appeared on NerdWallet.