Dubai-Based B2B Fintech Startup Lune Makes Financial Transaction Data Useful For MENA Entities For Alexandre Soued and Helal Lootah, co-founding their Dubai-based fintech startup Lune came about as a result of observing a massive lack of financial literacy among UAE residents.

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur Middle East, an international franchise of Entrepreneur Media.

This article is part of an ongoing series covering startups that have been a part of the Mohammed Bin Rashid Innovation Fund (MBRIF) accelerator program.

For Alexandre Soued and Helal Lootah, co-founding their Dubai-based fintech startup Lune came about as a result of observing a massive lack of financial literacy among UAE residents. But when the high school best friends turned co-founders first decided to address the issue, it didn't immediately lead to the creation of the B2B startup that they sit at the helm of today. "Our first version of Lune was a B2C mobile application designed to help social saving- i.e. it helped people manage and understand their spendings," Soued recalls. "However, it didn't go as planned, but we were able to start off in the deep end, and really grow as entrepreneurs and founders through that experience."

And as is the sign of any resilient entrepreneur, the co-founders decided to use the lessons of their first venture and reengineer Lune to work as a B2B platform instead. "We saw the difference that our initial solution was making for everyday users, and, by working hand-in-hand with our users, the change that we could make," Soued explains. "We launched, after months of hard work, and we were finally able to see users jump onto the app, use it on a daily basis, and help us find ways to make it even better. After a few weeks, we started getting interest from institutions who saw what we were doing and wanted to be a part of it."

Here, what remains evident in Soued's replies is that, at its core, Lune's B2B approach still seeks to dispel the dearth in financial literacy that Soued and Lootah had initially noticed. "At first, we were skeptical thinking that we'd be better off alone, but then we realized that we could do more for financial literacy by working together," he explains. "It meant that we could help more consumers across MENA to understand their finances, clearly and concisely, without even the need to download another app."

Helal Lootah, co-fouder, Lune

Today, Lune partners with businesses, financial institutions and fintechs in its mission to democratize financial data. "We employ a software-as-a-service (SaaS) business model and partner with banks, fintech companies, and retailers to empower them to give their customers the insights and products that they need," Soued says. "Lune is thus focused on unlocking the power of transaction data, and empowering consumers to build a brighter financial future. Essentially, we take raw transaction data, such as credit card spend, and we enrich and analyze it to provide a clear overview of how, where, and when that spend is occurring. We provide this to both our partners and to their end-consumers."

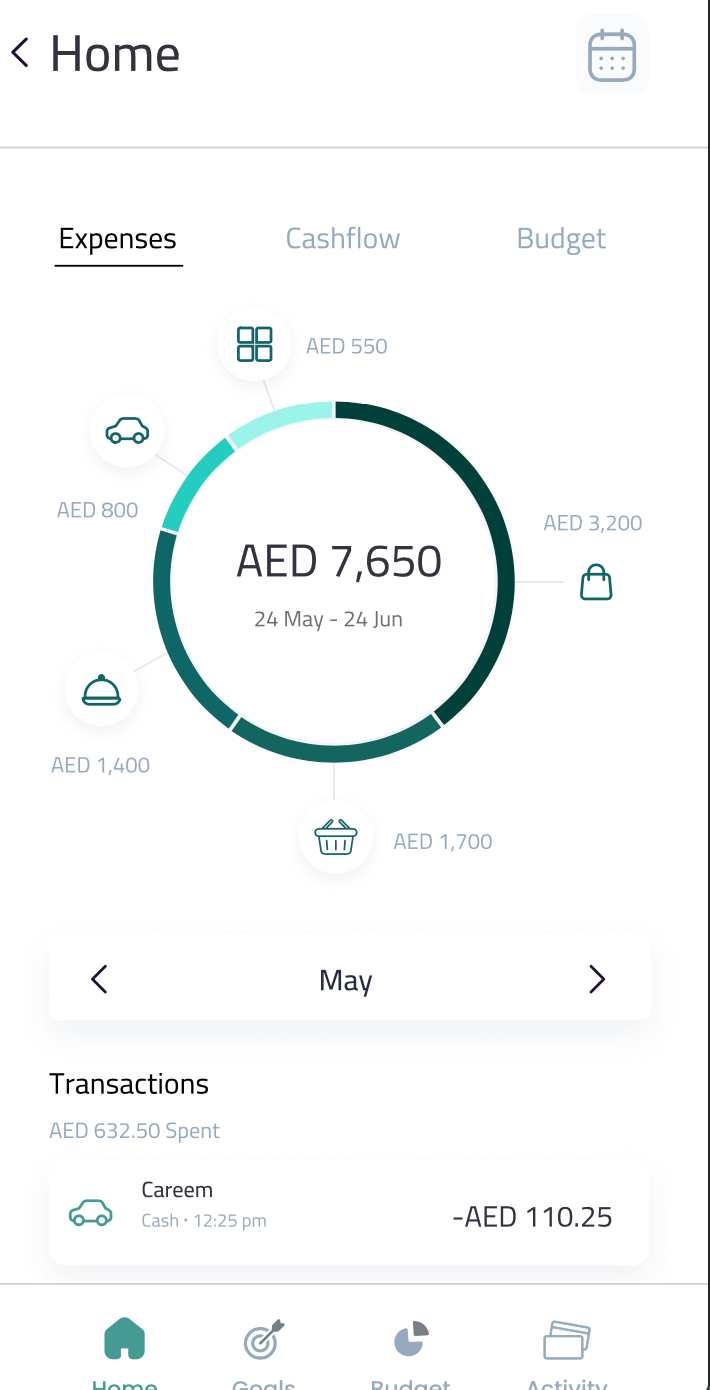

Among Lune's many offerings are money management tools that enable a given enterprise's customers to manage their expenses, cash flows, and budgets. It also helps customers identify financial trends, keep an eye out for future savings, and understand their own spending habits as well. This, in turn, provides companies with a straightforward way to analyze customer spending data and also offers financial accounting tools for data including customer balances, debts, recurring expenses and cash flows.

And according to Soued, it is the simplicity of its offerings that is one of Lune's greatest strengths. "Lune has been designed to give end users a clear overview of key metrics from day one," he says. "So, our clients don't need to take resources away from their analytics or technology teams to use Lune- we serve as an analytics tool that anybody can use to derive insights, saving our clients both time and money."

Here, Soued states something that is perhaps truly worth quoting when talking about financial literacy and data. "Labeling transactions is as much of an art as it is a science," he says. "If it's not properly maintained, then the rest of the solution is rendered useless." This encapsulates the significance of Lune's second offering, transaction enrichment (the process of turning ambiguous transaction information into clear and categorized data), which Lune achieves by using its enrichment applications programming interface (API).

"We handle all data cleansing and enrichment through our SaaS model, where we continuously maintain and update that database on our clients' behalf," Soued says. Being built as a plug-and-play solution has also proven to be another one of Lune's unique selling points, with Soued saying, "Our integration has been built by developers, for developers, and hence, our clients can go-to-market in weeks and not months. Additionally, since we're building for the next generation of finance, Lune is also data-agnostic. This means our clients can leverage direct bank APIs, open banking, or both to unlock the power of transaction data."

Lune is currently in a proof-of-concept stage with partners in the UAE, Saudi Arabia, and Oman, which offer the startup a combined user base of over one million customers. Lune's funding so far has come through investments made by the co-founders' friends and families, as well as angel investors. "Our goal from the beginning has been to build a business that solves a genuine pain point through technology and innovation, and I'm happy to say that our investors are all aligned with that vision," Soued says.

Meanwhile, as a participant in the MBRIF program, Soued and his team have been able to inch closer to fully realizing the vision they have for Lune. "The MBRIF program has been fantastic so far- it's been great to meet and be a part of a program with such a strong sense of community," Soued says. "The founders that we've interacted with are all truly passionate about what they're doing, and I do believe that some of them have the power to change the world, and being in an environment like that is truly inspiring."

And if Soued's plans for the future are anything to go by, he seems to be moving forward with much optimism. "Over the next few years, I believe we will see Lune going from being a local player to a global player," he says. "We're seeing a massive shift where financial institutions realize the importance of simplifying transaction data, both for creating better experiences and empowering consumers, and we aim to be the infrastructure that enables that shift."