7 Interesting Financial Facts About Millennials The millennial generation has its virtues and shortcomings, but more often than not, millennials are considered to be financially indisciplined.

By Portia Antonia Alexis Edited by Jason Fell

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur Europe, an international franchise of Entrepreneur Media.

Being a millennial has its virtues and shortcomings, but more often than not, millennials are considered to be financially indisciplined, frittering away their money on avocado toasts and lattes. And it's not just the UK millennials, but their U.S. counterparts face the same bashing from experts.

But how much of it is true? Are all millennials financially reckless?

Before we get into these details, let's start by defining the millennial generation. Millennial is a generation of individuals born between 1980 to 1996, the most accepted age range, who are usually in their early 20s to late 30s. Millennials form 13.9 percent of the total UK population.

This post is going to understand multiple aspects of millennials' financial life, including income, saving, spending, debt, and retirement preparedness. If you're a millennial, we're merely putting together a picture based on research, so read on the post and see where your generation stands financially.

Here are seven interesting financial facts about millennials.

1. Slow income growth.

Millennials lag their previous generations when it comes to income growth and their net take-home salary. Data from the Insitute of Fiscal Studies finds that it is the first time that people in their 30s are earning less than those who were born a decade earlier. The median annual household income has declined for those born in the early 1980s in comparison to those born in 1970s.

A lower median income has had a direct impact on millennials wealth accumulation potential. They've accumulated 20 percent lower wealth than those born in the 1970s.

However, millennials with at least a bachelor degree or higher are fairing better than those without one. Only 10 percent of millennials with a bachelor degree or higher live with their parents in comparison to 16 percent with some college education and 20 percent high school graduates.

The report further reveals that it's not just the expensive millennial lifestyle but a combination of several economic factors, such as lower earnings, higher house prices, and rise in renting, leaving millennials financially behind.

It is essential to admit that millennials are working to build additional income sources. A report from Experian finds no improvement in the traditional wage growth for millennials, with expected absolute growth of 2.7 percent in 2020 and 3 percent in 2019, but self-employment is set to increase, especially for elder millennials. Millennials in the 36 to 40 year age bracket are likely to earn up to £53.81 every week through self-employment.

2. Questionable financial literacy.

This has been a talking point in the UK for quite some time, with the average individual owing more than £8,000 in debt (apart from the mortgage). Research finds that millennials, aged 25 to 34, are the most likely to have debt among all the generations.

It could be a surprise for most people, but millennials lag teenagers and baby boomers when it comes to financial literacy. Their scores in a mock GCSE financial literacy test were lower than 16-year-olds and baby boomers. One must understand that financial literacy education was made a compulsory part of the curriculum starting in 2014.

It's not the only report that questions millennials understanding of basic financial principles. According to research, as many as two-thirds of the millennial generation hasn't received financial education. Nearly 49 percent of the UK millennials don't know about the benefits of investing in shares in comparison to cash. Considering these facts, it's no surprise that over half of the millennials (55 percent) don't have a financial plan.

3. They like to splurge.

While many may argue that millennials have often been a target for bashing, research from Barclays provides ample proof about the average millennial's splurging habits.

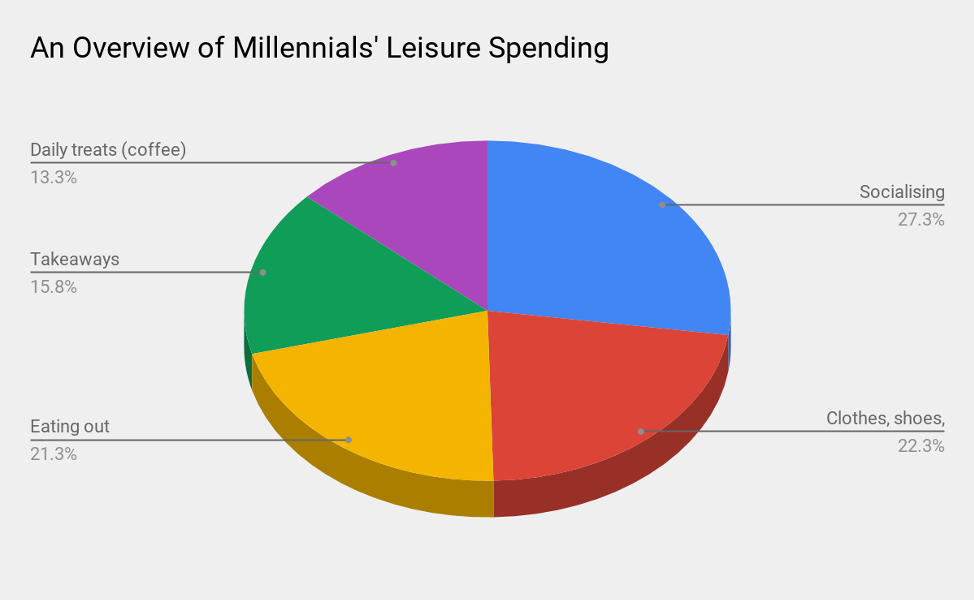

Image: Portia Antonia Alexis

The average UK millennial spends £3,312.72 every year on daily treats, eating out, coffee, takeaways, buying clothes, and socialising. Here is how it looks like:

- Socialising: £904.20

- Clothes, shoes, accessories: £738.96

- Eating out: £705.96

- Takeaways: £522.60

- Daily treats (coffee): £441

The research further reveals a considerable saving opportunity, allowing millennials to save up to £10.5 billion by making small changes in their spending habits.

One must note that two-thirds of millennials either save little or nothing at all. Making these minor changes will help them save an additional £662.54 every year.

In addition to these daily spends, millennials are guilty of indulging in impulse shopping. Studies reveal that as many as 95 percent of millennials admit being guilty of impulse shopping, with one out of five making impulse purchases every day. It is critical to understand that only 49 percent of these buyers feel content after the purchase. One-third of impulse shoppers regretted doing so after the purchase.

4. Still, they stress about money.

Money is a consistent topic of worry and stress for millennials. A report finds that nearly half of the millennial generation (45 percent) worries about debt, even more than they worry about their job or health. And that's not a one-off report.

Another study reveals that two-thirds of millennials lose sleep over money issues. When compared against the millennial population of the UK, it translates to over 10 million people. Some findings of the study are:

- Financial worries keep 66 percent of the millennials up at night.

- Among millennial parents, 73 percent have reported that money issues keep them awake at night.

- Another reason for stress is the image of a successful life pictured by social media. At least 66 percent of millennials blame social pressure, to accomplish certain milestones by a pre-defined age, for additional stress.

It is critical to add that money is a topic of concern for all the generations, but millennials, especially in the 18 to 34 years old bracket are apparently the worst affected.

One must note that millennials are facing altogether different challenges in their lives, including both micro and macroeconomic factors. For instance, the average personal debt between 2010 and 2016 has grown by 28 percent for individuals in 16 to 34 year age bracket versus 5 percent for individuals in 35 to 44 year age bracket.

When talking about macroeconomic factors, millennials are paying almost a quarter (23 percent) of their salary in housing costs, which is much higher than baby boomers, who spent an average of 17 percent at the same age.

5. They do manage to save some money.

Millennials face scrutiny when it comes to their spending habits. For some reason, one can never finish an article about millennials financial habits without finding a reference of avocado toasts or lattes.

However, contrary to popular beliefs, millennials are avid savers. A survey from Revolut finds that roughly two-thirds of the millennial population saves regularly. As per the financial firm, the average millennial is saving £174 a month. Millennials in London save more than other regions, putting away £254.95 per month.

The primary reasons millennials are saving for are to accumulate funds for their first-home (33 percent) and to go on a holiday (30 percent). These figures are somewhat consistent with the Experian report, which estimates millennials' holiday spending to grow by 4.9 percent in 2020.

When considering saving patterns, millennials are putting away their money in savings accounts, with younger millennials more likely to choose traditional current or saving accounts as compared to the ones near the higher range.

Only a quarter of the millennials are investing in stocks or equity investments. It's hard to blame millennials for their conservative investing habits as the generation witnessed the 2008 financial crisis taking away their savings.

6. ...But not for retirement.

Retirement planning isn't an exciting topic for most people; nonetheless, it's a critical aspect of our financial lives. When it comes to retirement savings or planning, millennials are facing a shortfall of 60 percent or more.

According to research, millennials will require 67 percent of their current income during retirement, which comes out to be £26,800, based on an annual income of £40,000. However, lower earnings, higher housing prices are likely to delay millennials' retirement to 68 years, up from 66 for their parents. Millennials will have to save an additional £80,000 to retire at the same age as that of their parents.

There are multiple reasons for this shortfall, with one being a limited understanding of pensions and retirement planning. A Royal London research indicates that one-third of millennials didn't know about the pension contributions made to their account. Another 22 percent didn't know that they have a pension. Over 18 percent of the UK millennials have no idea about how much income will they require during retirement.

7. They prefer paying for experiences rather than posessions.

Multiple pieces of research indicate that millennials prefer experiences over things, which is the primary reason behind a higher "experience spending." A Deloitte survey puts travelling and seeing the world as the number one aspiration for millennials (57 percent), followed by earning a higher salary (52 percent) and buying their own houses (49 percent).

A shift from materialism to experiences has fueled the growth of the experience economy over the past decade. Research finds that at least 96 percent of the UK population has spent money on leisure activities during the first quarter of 2019. It is crucial to understand that leisure activities involve dining out, takeaway, streaming subscriptions, cultural events, drinking at pubs and bars, and sipping your favourite coffee.

How do millennials stand financially?

A close look at each of these sections reflects that millennials are a little behind when it comes to their finances. However, it's critical to analyse the findings of each of these sections to depict a clear picture.

- Income: Millennials are behind the curve in terms of their current income level, especially when it comes to Gen X and baby boomers.

One possible solution to overcome their relatively lower income is to upskill and improve their career trajectory. One must note that one out of every three jobs in the UK might be lost to automation in the coming 10 to 20 years, which means not only will it help boost millennials' income, but it will also make them future-ready.

- Financial literacy: Millennials fare poorly when it comes to financial literacy and understanding of investing fundamentals, which limits their chances of long-term wealth accumulation and investment returns.

Millennials can overcome this gap through online financial courses or by working with financial advisors. Instead of hiring a full-time financial advisor, they can pay for individual sessions.

- Spending habits: The average UK millennial spends over £3,000 in leisure activities, which could otherwise be used for long-term financial goals.

Taking small cuts from their discretionary spending can make a huge difference in the average Briton's savings.

- Money worries: If there is one thing that we know for sure is that millennials don't have it easy. Lower wages, higher housing prices, student debt, and living costs millennials face have complicated their financial lives.

Millennials have to be smart about their financial planning. The only way to rid these worries is to create a strategy for handling their existing money issues and execute it.

- Saving habits: Unlike popular belief, millennials are good savers, and it's one of the very few things working in their favour. However, they have to learn more about investing and focus on assets that can boost their wealth generation abilities.

The best way millennials can deal with their current anxiety related to financial investments is to improve their understanding of different asset classes. They can seek professional help to start investing. Diversification could be an answer for their need for financial security.

- Retirement planning: Saving for retirement is another area that millennials need to champion to improve their financial lives. One must note that a lack of basic financial knowledge is a key reason in the millennials negligence towards retirement planning.

- Experience spending: Millennials value experience over materialism which is a healthy sign for society. However, they need to balance their spending on leisure activities and contribute a portion to long-term financial goals.

Millennials as a generation have had multiple setbacks, but that shouldn't keep them from reaching their full financial potential. There are some gaps in their current financial circumstances, but it's possible to address them through financial education and advisory services. The most critical takeaway from this entire post is that millennials need to own their financial mistakes and commit to being better in the future. There aren't any problems that a good strategy and a disciplined approach couldn't address.