Trustted By Banks Trustt counts HDFC Bank, Yes Bank, AU Small Finance Bank, Suryouday Bank, and RBL Bank as some of its marquee clients. The start-up has been operationally profitable since 2017 and continues to be true to the principles of Unit Economics

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

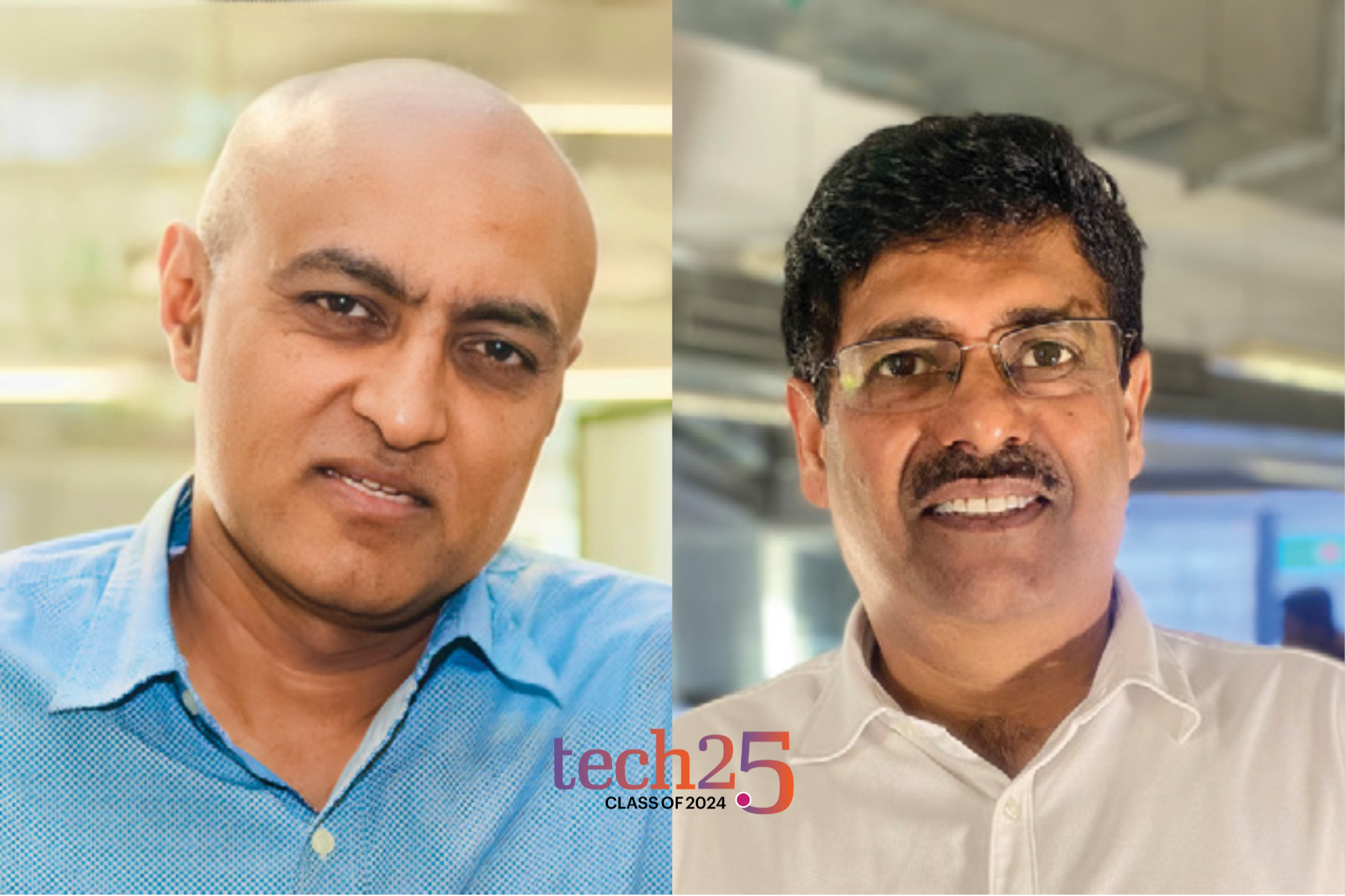

It was in 2014 when Srikanth Nadhamuni and Gautam Bandhopadhyay forged a partnership to establish Trustt as a provider of digital banking solutions. It is a mobile-first, cloudnative, and AI-powered Digital Banking Platform having four major offerings- Digital Lending, Digital Distribution, Digital Identity, and Trustt GPT.

Calling its API-enabled powerful banking stack revolutionary in the Banking industry, Srikanth Nadhamuni shares "This platform of products and services is available as a SaaS service, allowing the bank to focus on banking and financial products while we focus on ensuring a tech platform that delivers 100% digital straight-through processing, that lowers operational cost, increases customer delight, and grows AUM, deposits, payments, and hence the bottom line for the Bank or NBFC."

"By offering a SaaS solution, Trustt enables financial institutions to focus on their core competencies while delivering a seamless, cost-effective, and customer-centric banking experience. This transformative approach is set to redefine the banking landscape, offering a glimpse of what the future of banking could look like," adds Gautam Bandhopadhyay.

It counts HDFC Bank, Yes Bank, AU Small Finance Bank, Suryouday Bank, and RBL Bank as some of its marquee clients. The start-up has been operationally profitable since 2017 and continues to be true to the principles of Unit Economics. But every venture has its own set of challenges to overcome. "Our biggest challenge is to ensure that technology architecture remains at the cutting edge, while we bring functional stability in a fast-paced technology world," shares Bandhopadhyay.

He further that tell the company proactively embraces new-age technology, "One such example is the launch of Trustt GPT - India's first GPT product suite for banking that powers Conversational Product Discovery, Customer Onboarding, Servicing, and Sales Co-Pilot." In the next two years, Trustt aims to expand its presence into new markets, such as Southeast Asia and North America.

TECH SPECS:

•Year of inception - 2014

•No. of employees - 200+

•Revenue for FY 2022-23 - USD 4.5 million

•External funding received so far - USD 10 Million

in 2015 by Khosla Ventures

•Major clients - HDFC Bank, Yes Bank, AU Small Finance Bank, Suryouday Bank, RBL Bank, and

more

•Any IP developed/patented:- Trustt Digital Lending Platform, Trustt Digital Distribution Platform, Trustt Digital Identity Platform, Trustt GPT. We have not filed for any patents so far.