Is Frontline's 20% Dividend Too Good To Be True? Tanker firm Frontline offers an impressive 20% dividend. But dividends in the shipping industry can change quarter-to-quarter. Can Frontline sustain it?

By Pat Crawley

This story originally appeared on MarketBeat

The Cyprus-based tanker firm Frontline (NYSE: FRO), on May 31, posted stellar earnings of $0.90 per share and declared a $0.70 dividend. Given the company's stock price of $13.70, this makes for a mouth-watering annualized yield of over 20%.

But the question arises, can this be sustained?

Frontline: A Quick Primer on the Tanker Market

Operating within the crude oil tanker industry, Frontline's fleet comprises 66 vessels utilized for transporting crude oil and refined oil products. The company's revenue stems from a daily rate charged to customers needing to transport oil from one port to another.

The operation of tankers incurs mostly fixed costs. Profits surge when the daily charter rate outweighs the fixed operating expenses, yielding substantial free cash flow. This high degree of operating leverage works wonders within favorable market conditions, flooding firms with cash. Conversely, faced with dwindling oil demand or an oversupply of tankers, many firms cannot bear the fixed costs of operating their fleet, often going bankrupt or being taken over.

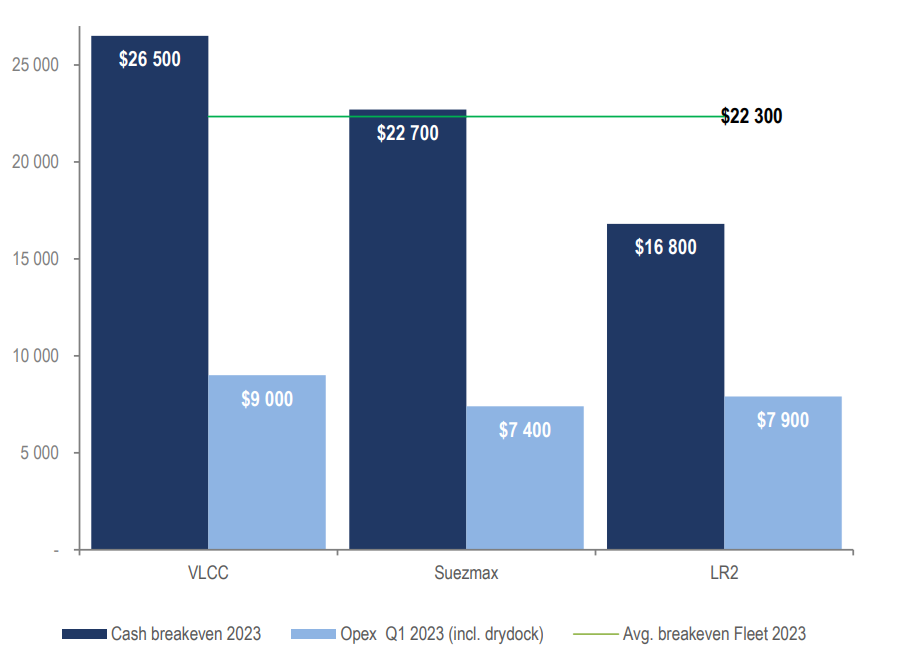

As a point of demonstration, Frontline's break-even prices for the three types of vessels it runs are in the following chart:

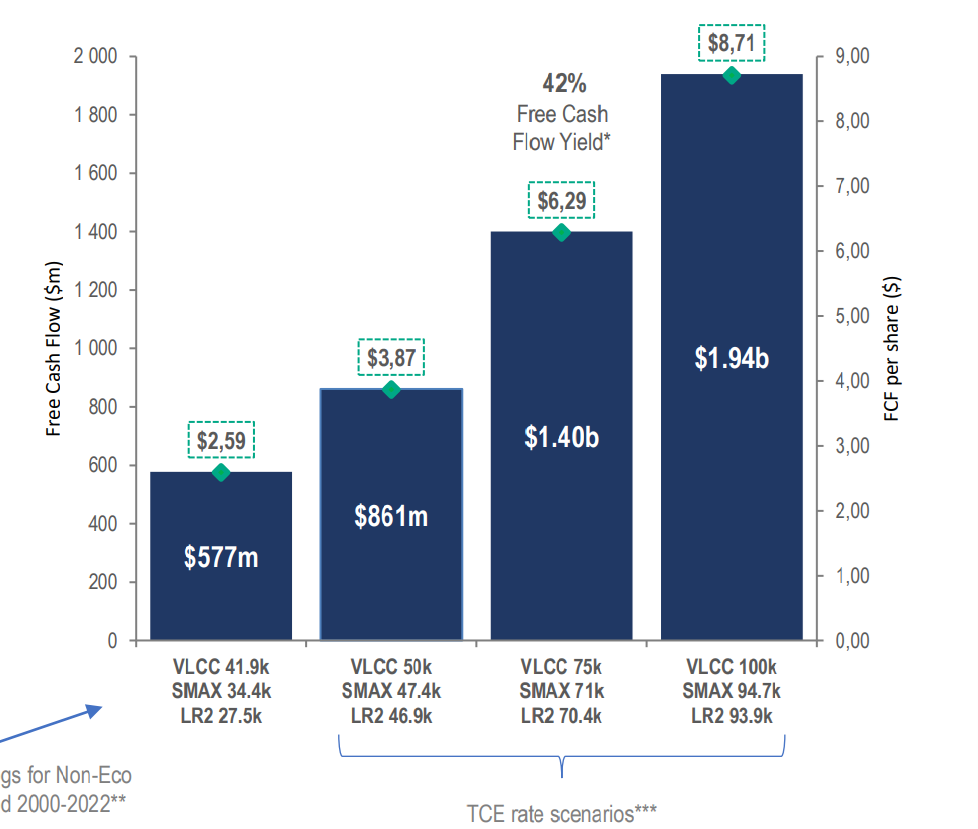

And here is the company's estimated free cash flow per share at different daily rates:

Each incremental increase flows almost directly to free cash flow. But the same math works against companies like Frontline on the downside. If tanker rates crash, it's pure downside with little opportunity to cut costs other than docking ships.

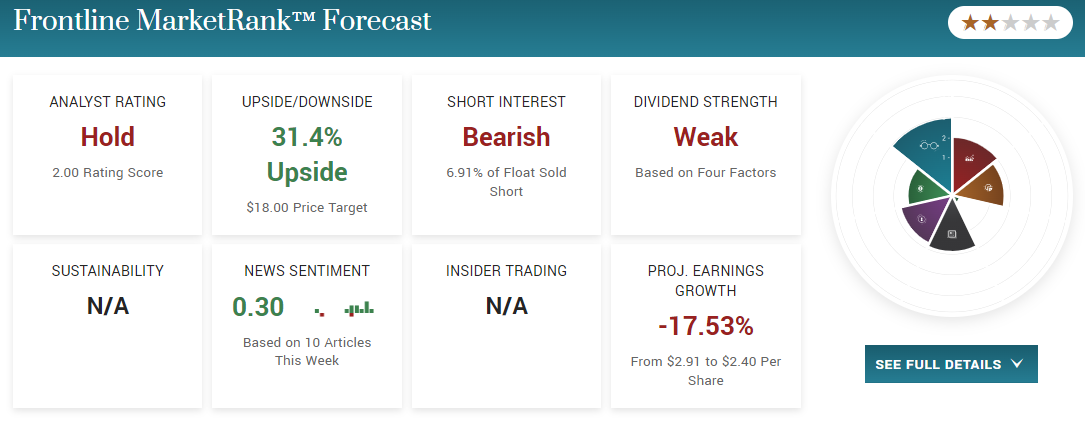

Check out MarketBeat's MarketRank Forecast for Frontline:

Is Frontline's Dividend Sustainable?

For this reason, the tanker market is highly volatile, and any declared dividend can't be regarded in the same manner as those from stable firms like Pfizer or Philip Morris.

Playing the tanker dividend game is typically a short-to-medium-term trading strategy rather than a long-term investment. It serves as a bet on tanker market conditions rather than a place to park your money like one would with a dividend ETF.

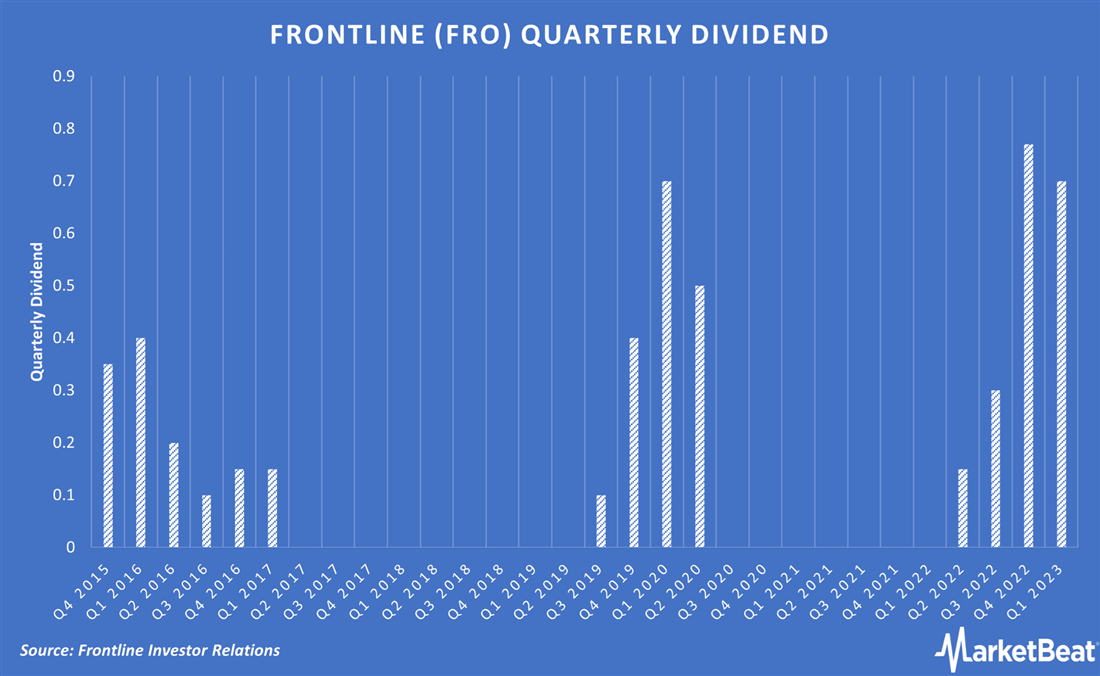

The dividend history of any tanker firm is volatile, and Frontline is no different. Dividend rates often change quarter-to-quarter based on quarterly cash flows. For instance, below is a chart of Frontline's quarterly dividend since 2015:

As you can see, Frontline pays out a significant portion of its cash flow as dividends when conditions are good. In the most recent quarter, the company earned $0.90 per share and paid out $0.77 in dividends. Looking forward to the second quarter of 2023, Frontline will pay $0.70 in dividends and expects similar operational results as the first quarter.

Hence, dividends in the tanker market are essentially a quarter-to-quarter bet on robust cash flow. If a company like Frontline experiences a few lackluster quarters, dividends will likely be trimmed.

This begs the question, how is the tanker market faring currently?

Tankers: A Bull Market?

Tanker firms like Frontline look well-positioned to continue posting strong cash flow numbers to support hefty dividends. One of the most significant factors underpinning the abnormal strength of tanker firms is the structural shortage of new vessels.

About 12% of the global tanker fleet is 20 years or older, nearing the typical lifespan of around 25 years. There's an immediate need to replace a substantial portion of the global fleet. However, the prohibitive costs of building new capacity and the shipyards' preference for manufacturing more profitable LNG carriers make it challenging to expand the global fleet.

Regarding basic supply and demand of tanker chartering, both the China reopening and Western sanctions on Russia have been a boon for Frontline and other tanker firms.

While the entire energy market hoped for more robust demand from China once it reopened, Chinese oil imports were still quite strong. Frontline recorded its highest number of VLCC (very large crude carrier) shipments to China in its history in the first quarter of 2023.

The Western sanctions on Russia have forced Russia and its slew of trading partners in the Middle East, Asia, and Africa to embark on inefficient routes now that it can't sell oil to its European neighbors. This translates to more tonne miles and more profits for tanker firms like Frontline.

One of the best sources for up-to-date tanker market insights is the Fearnleys Pulse, a weekly report on the global shipping market.