Corporate Taxes

7 Advanced Tax Strategies for Self-Employed Professionals

With 2023 coming to a close, here are seven advanced tax strategies to help you keep more of what you make.

Stop Throwing Away Money: 5 Tax Incentives Your Business Is Missing Out On

What you don't know about tax credits may cost you your business. Ensure you know how to maximize your tax savings this upcoming year.

10 Important Tax Numbers Every Business Owner Should Know to Save Big on Their Taxes This Year

Boring? Not when you consider the money you could be saving.

These 9 States Have No Income Tax — But Are They Better or Worse For Your Finances? Here's Everything You Need to Know.

Does your state require income tax? Discover everything you need to know about nine states with no income tax in this detailed guide.

Taxes on Small Businesses Across the Globe, Mapped: See Where Rates Are High, Low — and Nonexistent

A study from OnDeck charts the massive corporate-tax discrepancies among nations; find out how yours compares.

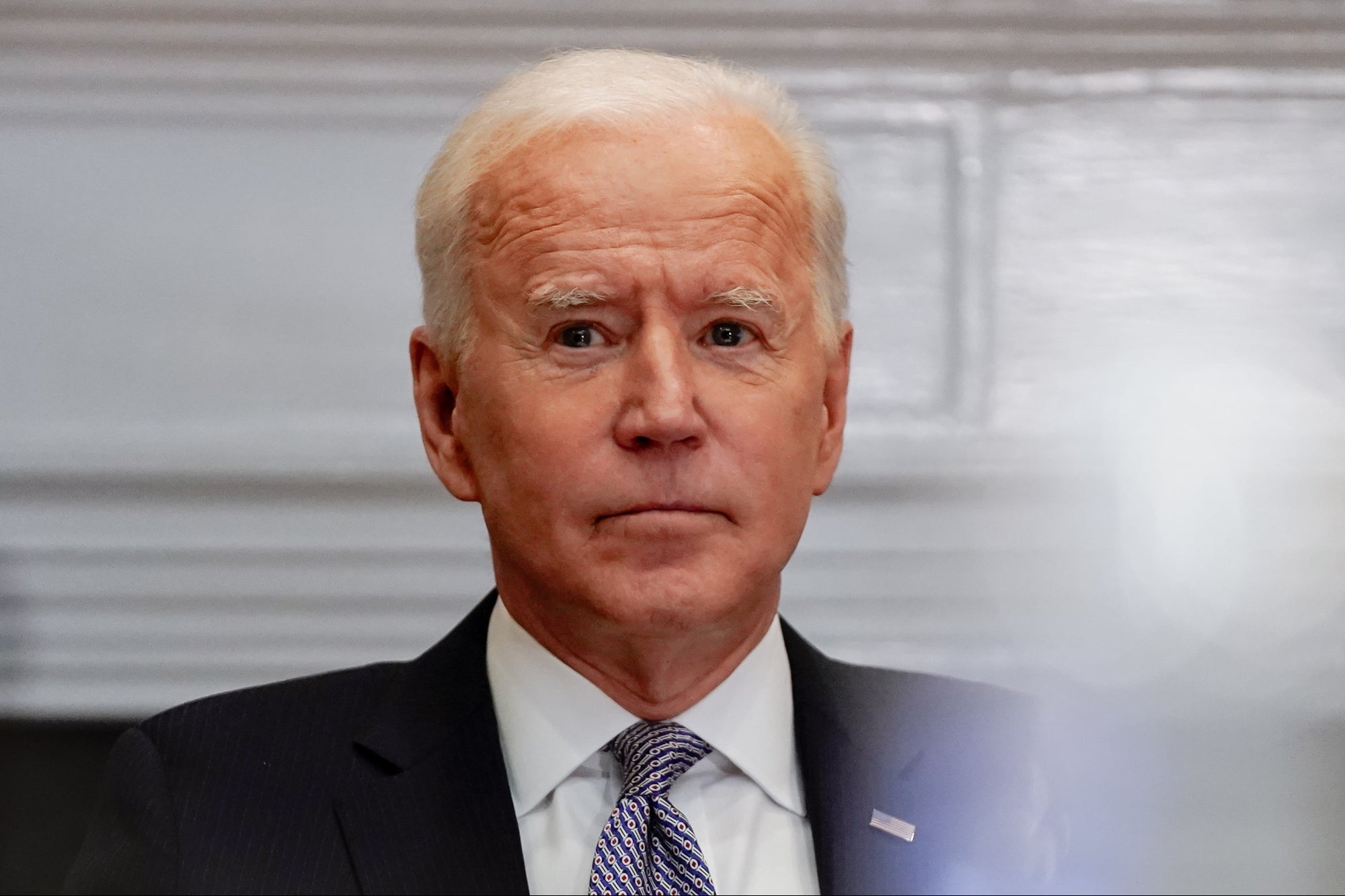

Will Biden's Proposed Tax Hikes Prevent Companies From Hiring?

A recent survey reveals that most CEOs don't agree with the president's plan to increase the corporate tax rate.

Nike, HP and Other Large Corporations Got Away With Not Paying Any Federal Taxes on Their 2020 Profits

At least 55 of America's largest companies avoided federal taxation last year by using certain tax breaks, some of which had been revived during the pandemic.

Important Aspects Of E-Invoicing Decoded

The government plans to eventually get all businesses under its purview, to streamline tax processes and curb tax evasion

#5 Sectors Affected by India's Consumption Slowdown

FMCG, automobiles, steel, consumer durables and real estate are among those which have experienced limited to deep impact

Corporate Tax Cut is a Win-Win for Businesses, Investors & Stakeholders. Here's Why

Finance Minister Nirmala Sitharaman made some announcements that will prove to be a game changer and the biggest reform since 1991

Finally, the Feds Are Cutting Startups Some Slack: Why the New Tax Law Is a Game-Changer

The Tax Cuts and Jobs Act: What's in it for you?

Small and Medium Businesses Get a shot in the arm in #Budget2018

The step comes as a relief post demonetization & GST that broke the back of MSMEs countrywide

Budget 2017: How has the Union Budget Altered the Taxation Scenario in India?

Despite high hopes for a revamped section 80C, however, tax savings instruments remain untouched. The tax deduction limit under 80C remains 1.5 lakhs.

5 Tax Liabilities & Amendments Announced in India's Budget 2017

FM Arun Jaitley said data mining post demonetization will help in an increase in tax revenue.